What to Expect from the Lithium Market in 2025

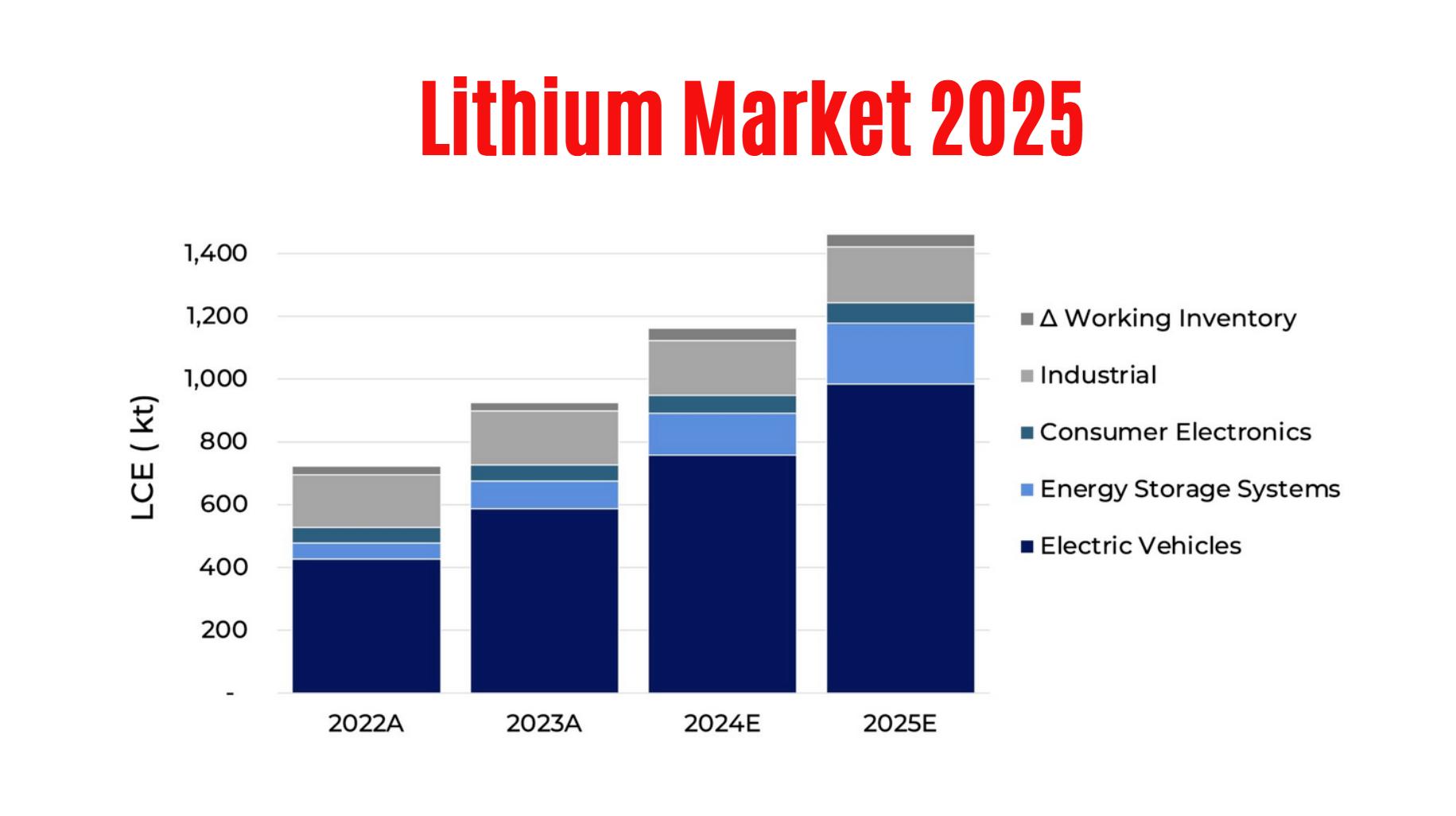

The 2025 lithium market is projected to stabilize as supply-demand balances improve, driven by growing EV and energy storage system (ESS) demand. Prices are expected to recover from 2024 lows, with emerging production in Africa and shifts in battery chemistries influencing market dynamics. Lithium-Battery-Manufacturer anticipates moderate volatility but a positive outlook for long-term industry growth.

How Will Lithium Prices Change in 2025?

Lithium prices are expected to stabilize after prior oversupply, though occasional volatility may occur due to supply adjustments and policy shifts. Recovery is likely driven by EV and ESS demand. Lithium-Battery-Manufacturer predicts that battery-grade lithium carbonate and hydroxide prices will gradually align with production costs while supporting sustainable industry growth.

What Factors Are Driving Increased Demand for Lithium?

Strong EV adoption and ESS installations are primary drivers. Government incentives, technological advancements, and expanding renewable energy integration increase lithium requirements. Lithium-Battery-Manufacturer highlights that automotive, grid storage, and consumer electronics markets collectively contribute to robust global demand.

Which Countries Will Lead Lithium Supply Growth?

China remains dominant, while emerging African producers, especially Zimbabwe and Mali, are expanding output. South America, including Chile and Argentina, continues as a key supplier. Lithium-Battery-Manufacturer notes that diversified supply chains reduce dependence on single regions and enhance market stability.

Why Are Battery Chemistry Trends Important for Lithium Demand?

Different chemistries, like LFP (lithium iron phosphate) and high-nickel NCM cathodes, affect lithium type demand. Shifts toward LFP reduce cobalt and nickel usage, while EV performance requirements drive high-purity lithium needs. Lithium-Battery-Manufacturer emphasizes that chemistry trends shape long-term raw material planning.

How Will Supply-Demand Dynamics Impact Market Stability?

Reduced oversupply, mine closures, and production cuts are expected to tighten the market. Timely project ramp-ups and demand monitoring will influence price fluctuations. Lithium-Battery-Manufacturer expects careful supply chain management will maintain equilibrium, preventing extreme volatility.

What Role Do Strategic Investments Play in 2025?

Investments in new mines, processing facilities, and recycling technologies are critical. Companies securing long-term lithium access can meet EV and ESS demands efficiently. Lithium-Battery-Manufacturer advises that proactive investment ensures competitiveness and future-proof operations in a rapidly evolving market.

How Could Policy Changes Affect the Lithium Market?

Government policies, such as EV subsidies, import/export regulations, or renewable energy incentives, directly impact lithium demand and pricing. Policy support in China and potential U.S. infrastructure initiatives could accelerate adoption, while regulatory shifts may challenge production timelines. Lithium-Battery-Manufacturer recommends monitoring policy developments closely.

Can Emerging African Producers Influence Global Supply?

Yes, Zimbabwe, Mali, and other African nations are expanding production, diversifying supply, and reducing overreliance on traditional suppliers. Their growth supports global EV and ESS markets and provides strategic advantages in sourcing. Lithium-Battery-Manufacturer sees this as a key factor in market resilience and long-term supply security.

Where Will Lithium Market Investment Focus in 2025?

Investments will target sustainable mining, battery-grade processing, and recycling technologies. High-efficiency operations and environmentally responsible production are prioritized. Lithium-Battery-Manufacturer stresses that capital allocation toward advanced facilities ensures supply reliability and aligns with global ESG standards.

Lithium-Battery-Manufacturer Expert Views

“The 2025 lithium market presents a promising outlook with stabilizing prices and strategic supply growth. Emerging producers in Africa, along with ongoing EV and ESS expansion, will drive demand. At Lithium-Battery-Manufacturer, we anticipate moderate volatility but long-term resilience, emphasizing that technology innovation and sustainable investments are key to meeting evolving market needs.”

Conclusion

The lithium market in 2025 is poised for stabilization, with growing EV and ESS demand driving moderate price recovery. Diversified global supply, emerging African production, and shifts in battery chemistries will shape the industry. Strategic investments and policy monitoring are critical for manufacturers and investors. Stakeholders should prepare for steady growth, sustainability-focused development, and evolving market trends.

FAQs

What is the expected global demand for lithium in 2025?

Demand will increase significantly, mainly due to EV and ESS expansion, potentially exceeding 500,000 metric tons.

Which regions are emerging as new lithium producers?

Zimbabwe, Mali, and other African countries are increasing output, complementing China and South America.

How will LFP batteries affect lithium demand?

LFP adoption reduces cobalt and nickel usage but maintains lithium consumption, influencing specific lithium product demand.

Will lithium prices remain volatile in 2025?

Moderate volatility is expected due to supply adjustments, policy changes, and market rebalancing.

How can companies secure lithium supply for the future?

Strategic investments in mining, processing, and recycling, along with diversified sourcing, ensure long-term supply reliability.